Discover the visual of SPACE 2024

3 things to love about Zerose erythritol

|

Export To Kenya - 4th Food Kenya 2023

Take part in the most prestigious food

|

|

|

|

For an urgent response, please feel free to call |

Profit warning at infant-formula group China Feihe

Shares in the Hong Kong-listed company curdled today after Feihe said it expects first-half earnings to fall.

Half-year profits at China Feihe could fall by more than a third, the infant-formula producer has warned.

The Hong Kong-listed company said yesterday (10 August) it expects its first-half net profit to drop by 23-36% year on year.

In a stock-exchange filing, the group pointed to the “low birth rate in China”, competition and an expected net loss from listed subsidiary YuanShengTai Dairy Farm.

China Feihe expects to book first-half revenue of around 9.58bn ($1.32bn) to 9.87bn yuan. A year earlier, the company posted half-year revenue of 9.67bn yuan.

In 2022, the business generated revenue of 21.31bn yuan and a net profit of 4.95bn yuan.

It expects to publish its first-half accounts by the end of the month.

Shares in China Feihe closed down 11.42% at HK$4.42.

China Feihe’s main products include infant milk formula products, adult milk-powder, liquid milk and goat milk infant formula.

The company’s formula brands include Astrobaby and Organic Zhenzhi.

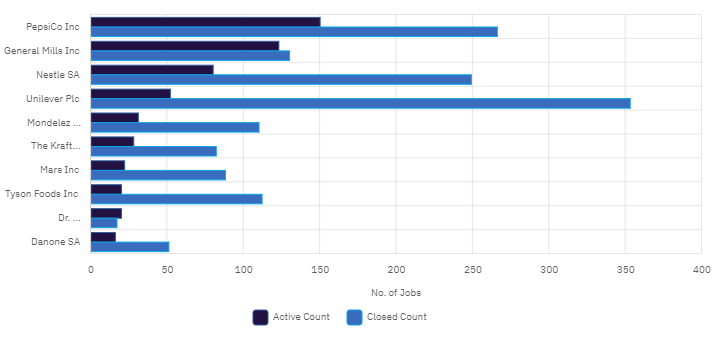

Signal: PepsiCo, General Mills lead AI hiring in food

The US giants had the most AI-related jobs open for application among food manufacturers in the first seven months of the year.

PepsiCo and General Mills have led the list of major food companies hiring for roles linked to AI so far in 2023, data suggests.

The US giants had the most AI-related jobs open for application among food manufacturers in the first seven months of the year, GlobalData, Just Food’s parent, said.

Between 1 January and 31 July, PepsiCo was advertising 150 positions linked to artificial intelligence, followed by General Mills with 123 open roles.

GlobalData’s job analytics database tracks daily job postings across multiple industries, including consumer goods. As part of the research and intelligence company’s analysis, it groups jobs by theme, providing an indication of where businesses are focusing their hiring efforts.

Nestlé ranked third, with 80 “active” AI-related roles at the KitKat maker. “Active” jobs denote roles open for application.

Unilever (with 52) and Mondelez International (31) rounded out the top five.

Overall, among the food companies monitored by GlobalData, some 896 posts were open for application during the period that were tied to AI.

“AI doesn’t replace. It augments” – how AI helps Mondelez’s R&D

Our signals coverage is powered by GlobalData’s Disruptor data, which tracks all major deals, patents, company filings, hiring patterns and social media buzz across our sectors. These signals help us to uncover key innovation areas in the sector and the themes that drive them. They tell us about the topics on the minds of business leaders and investors, and indicate where leading companies are focusing their investment, deal-making and R&D efforts.

eatmaker@list.ru

eatmaker@list.ru